Like millions of Americans, this weekend I took my family to see Beauty and the Beast, the latest adaptation of the Disney classic animated film. While viewers were left in delight as they made their way through the trials and tribulations of the Beast, Gaston, and of course, Belle, I was thinking about something altogether different. I was fresh off the 2017 Ethisphere Global Ethics Summit in New York City, where we hosted the World’s Most Ethical Companies, honoring 124 businesses from around the world that conduct themselves with honor. So, with my mind still focused on ethics, it occurred to me that the Beast was of his own making. When confronted with right and wrong, the prince chose wrong – with beastly implications that cost him dearly. There are similar parallels that can be drawn in our business ecosystem today.

Take Wells Fargo, for example – an enduring company with a 165-year-old brand that managed to make it through the financial crisis unscathed. We all know what happened in 2016; a scandal that included the creation of fake bank accounts over a four-year period between 2011 and 2015. A March 20th report in the Charlotte Observer revealed that the bank reported an 11 percent year-over-year drop in branch interactions in February, a measure that includes teller transactions and branch banker interactions. Consumer checking account openings declined 43 percent, while consumer credit card applications slid 55 percent. These were self-inflicted wounds that could take decades to heal. Of course, I could also have pointed to Volkswagen when discussing ethical lapses. These scandals should serve notice to all companies that ethics requires planning and the design that will stand up to adversity is one that authentically and perpetually promotes principles and honesty.

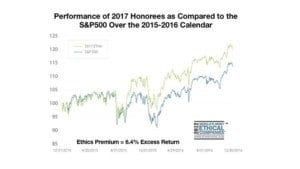

At Ethisphere we know that doing the right thing is not always the road most easily traveled. That’s why we honor those companies that do it. It takes grit to enact policies that are forward thinking rather than focused on short-term gains. It takes fortitude to make the right decision even when the ethical call can hurt the bottom line and it takes foresight to understand the difference and appreciate the long-term value. But the research is in. As we compare the honorees on our list of World’s Most Ethical Companies to the S&P 500, the gap (6% to the positive) is palpable – we call it the ethics premium (see stock chart on right). As sure as love will eventually redeem the Beast, companies that do good, do better.

Further research from our 11-time honorees clearly shows how the demand for corporate ethics and responsibility is not going away. If anything, it’s on the rise as younger generations – products of the Enron/Madoff age – who experienced first-hand the impact of a major economic crisis during their formative years, are not likely to disregard the effects of unethical business practices. With their ability to access information at their fingertips, finding in minutes what used to take days, they have little reservation about checking up on those companies they are considering worthy of their business. All the more reason why the “spell-proof” ethics plan is more vital than ever.

The bottom line is that in theory doing the right thing is a pretty simple concept. Merely live by the golden rule in your personal and business endeavors. That said, theory is easy; execution can be much harder. Yet those who do execute can typically avoid the torches and pitchforks outside the gates. Will your ethics program hold up against the angry mob? If not, you may want to reassess because when consumers or investors are storming the castle, it can make all the difference.